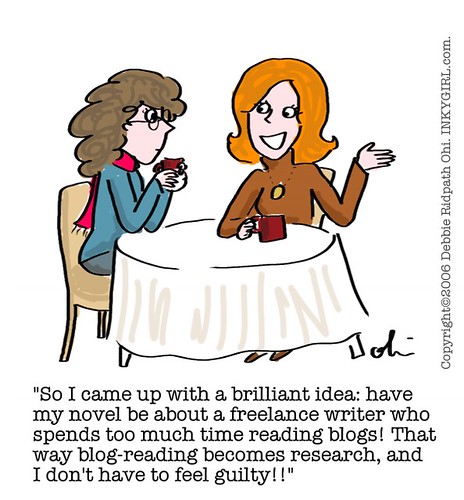

(Cross-posted to Inkygirl: Daily Diversions For Writers)It's nearly that time of year again, oh joy...

Here's my annual updated list of useful tax resources for freelance writers. Sadly (for me, anyway, since I live in Canada), most of the info is specific to the U.S., but I did manage to find some info specific to Canada and other countries, listed below in the "international tax info" section partway down this list.

I was unable to find ANY tax-related resources of use to writers outside of North America. Suggestions welcome! Please post anything I've missed in the comments section at the bottom of this page, thanks.

Tax Time Tips For Freelancers by Noah Davis. Published yesterday in Mediabistro.com.

Handling Writing Income and Expenses by Moira Allen. Excellent guide on record-keeping and tax preparation for writers.

Tips For Freelance Writers: Filing Taxes by Katharine Swan. Posted last year, so the info is likely up-to-date than many other articles I found.

June Walker's tax-related articles and tips for the self-employed: Addresses topics like business expenses, office-in-the-home expenses, and travel expenses.

Tax Deductions For Freelance Writers by Amy Derby. A brief outline of legitimate business expenses.

Freelance Tax FAQ from "Anti 9 to 6 Guide: Practical career advice for women who think outside the cube." Post is dated Oct. 27, 2006 and answers questions like "I work from home as a freelancer. Can I deduct a portion of my rent?" "Can I deduct my computer and printer?" "Can I deduct my Internet service if I use it for work?" "Do reimbursements for expenses incurred on my client projects count as taxable income?" "Is 30 percent of my income a fair estimate of what I can expect to pay in taxes?" "Do you think there is anything else I should know about paying taxes as a freelancer?"

Tax Tips For Freelance Writers by Julian Block. Six tax-related articles from Freelance Factor.

Writer's Pocket Tax Guide: by Darlene A. Cypser, Esq. Updated for 2007. $10.

Authors and the Internal Revenue Code by Linda Lewis. Lewis litigates cases before the United States Tax Court, representing the Commissioner of Internal Revenue.

Taxes and the Writer by Daniel Steven. Part of the Publishlawyer.com site. "As a writer, you've chosen to be a creative person. Writing, however, is a business. Whether you're a freelancer with your first sale, or an experienced author with a multi-book contract, it is worth understanding basic tax principles and rules."

Taxes and Freelance Writers-What To Do by Jessica Mousseau. Published Nov. 28, 2006. Includes tips on record-keeping.

Taxes For Writers by Cyn Mason. Includes a fascinating section called "Rules That Apply To Authors, An Historical Perspective."

Writer's Guide To Taxes: by Linda Adams and Emory Hackman. "You've made your first writing sale. Now what? Part of the job of being a writer is reporting that income to the IRS. What do you need to know?"

Click Here! Tax Help For Writers by Therese Walsh. List of useful resources for writers.

Canadian and Overseas Taxes

Ask-an-Expert: Deductible Expenses has Canadian tax experts answer the question: "I'm a full time freelance writer, and author of 6 books. I cannot find an accountant who can tell me what can I deduct from my home office? Beside the rent and telephone what else can I deduct from my taxes?"

Canadian tax: business expenses is a list of legitimate business expenses, listed on the Canada Revenue Agency's site.

Help! What Taxes Must I Pay?: Canadian focus. General tax-paying guide.

Income Tax Guide for Writers (2002) $9.00

"A useful tax guide for those in the business of writing, including details about the GST as it pertains to writers' income." See

The Writers' Union of Canada's list of publications.Taxes for the Writer Abroad by Nancy Arrowsmith. Part of Writing-World.com. Tips on how to avoid double taxation and how to avoid paying taxes in Europe.

And here are some related resources:

General tax info for the self-employed

Best Advice On How To Avoid An IRS Audit by Jack Oceano. "Home-office deductions are one example of a red flag."

Taxes and Freelancing by William Perez.

Mixing Personal and Business Expenses In A Freelance Business by William Perez.

Somewhat outdated but still has useful info

Tax Tips For Writers by Daniel Steven.

A Little Tax Advice For Writers by Mary Anne Mohanraj.

Tax Tips For Writers by Teresa V.M. Stone. A PDF file from the Winter-Spring 2001 issue of the Windy City Romance Writers newsletters.

writing life in

writing life in  Blog/news

Blog/news  writing life in

writing life in  Blog/news

Blog/news